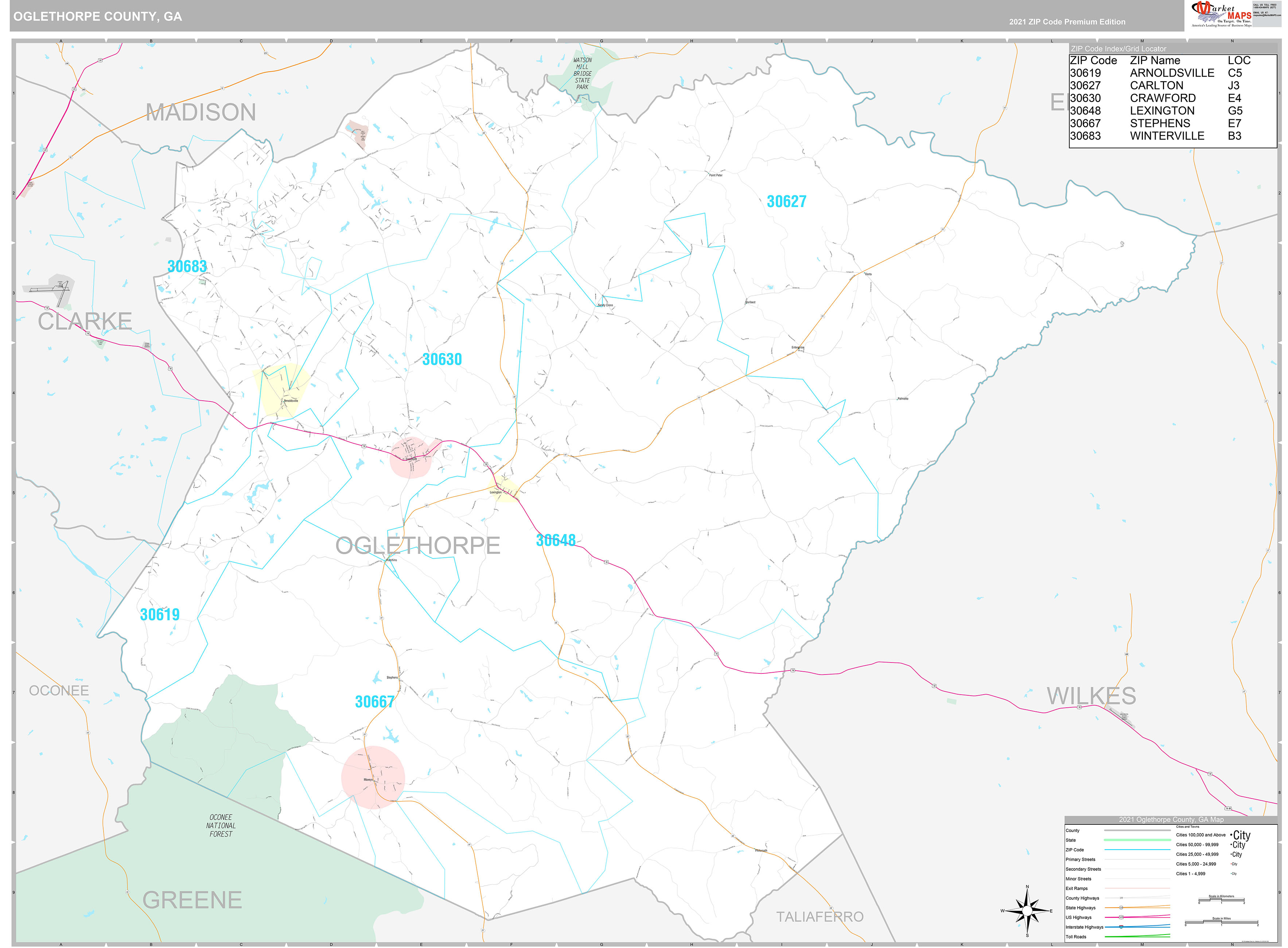

Qpublic Oglethorpe County Ga - Oglethorpe County, GA Wall Map Premium Style by MarketMAPS - MapSales The tax return is a listing of property owned by the taxpayer and the taxpayer's declaration of the value of the property. In an effort to better serve the taxpayers of oglethorpe county, ga, we are offering some of our services through the implementation of this website. Explore oglethorpe county's gis maps for detailed geographic information. You can reach us by phone or email between 8:00 am to 5:00pm, monday through friday. Please call the oglethorpe county tax assessors office for information before submitting application. In oglethorpe county, the time for filing returns is january 1 through april 1. *please note that the assessors office establishes values only. The board of tax assessors is responsible for property valuations, and the tax commissioner is responsible for collecting property taxes. The department of revenue is not responsible for maintenance of county websites. The board of assessors is a three member body of appointed citizens of oglethorpe county, serving on a part time basis, who meet once a month unless posted otherwise.

Oglethorpe County, GA Wall Map Premium Style by MarketMAPS - MapSales

Go To Sleep Gif Chuze Gym Locations 27 [LETTER3 5] My Dhr Food Stamp Application

In an effort to better serve the taxpayers of oglethorpe county, ga, we are offering some of our services through the implementation of this website. Access county maps, flood zone maps, and environmental maps. Explore oglethorpe county, ga property records including appraisal, zoning, real estate, mortgage, and ownership records. Discover tax information for oglethorpe county, ga. These returns are filed with the tax assessors office and forms are available in that office.

Use gis data to find land records, tax maps, and parcel viewers. In oglethorpe county, the time for filing returns is january 1 through april 1. Please call the oglethorpe county tax assessors office for information before submitting application. The board of assessors is a three member body of appointed citizens of oglethorpe county, serving on a part time basis, who meet once a month unless posted otherwise. Online access to maps, real estate data, tax information, and appraisal data. *please note that the assessors office establishes values only. Explore oglethorpe county's gis maps for detailed geographic information. Find data on property assessments, tax payments, and exemptions. These returns are filed with the tax assessors office and forms are available in that office. Discover tax information for oglethorpe county, ga. You can search our site for a wealth of information on any property in oglethorpe county. The information contained herein reflects the values established in the most current published tax digest.

In an effort to better serve the taxpayers of oglethorpe county, ga, we are offering some of our services through the implementation of this website. Discover tax information for oglethorpe county, ga. This directory links you to the tax records database and office for accurate, current information. The tax return is a listing of property owned by the taxpayer and the taxpayer's declaration of the value of the property. Explore oglethorpe county, ga property records including appraisal, zoning, real estate, mortgage, and ownership records. You can reach us by phone or email between 8:00 am to 5:00pm, monday through friday. Use gis data to find land records, tax maps, and parcel viewers.